The EU Digital Markets Act (DMA) was designed to level the playing field in the digital sector by setting clear criteria to pinpoint "gatekeepers" such as Google.

But, Google's response to this new regulation has introduced some substantial search changes, significantly impacting traffic and search visibility – especially for hotels and travel sites.

In this blog, we’ll go over what the DMA is, why it’s important, how it’s changing search, and how to measure the impact of the changes on your site.

Prefer video? Watch our 10-minute webinar instead!

Table of Contents:

- Research Study: Comparison Site SERP Feature Occurs 24% of Queries

- Research Methodology

-

How to Measure the Impact of the Comparison Sites SERP Feature

What Is The EU Digital Markets Act?

As previously stated, the EU Digital Markets Act was created to make the markets in the digital sector fairer and more contestable by establishing criteria to identify “gatekeepers” like Google.

Essentially, it lays down clear rules for big platforms to stop them from imposing unfair conditions on businesses and consumers.

The question is, why does it matter?

Google’s Response to the Digital Markets Act

The DMA does something very important for anybody in search: it imposes a no-preferencing rule on gatekeepers.

In the case of Google specifically, this essentially means that Google’s own vertical search services – such as Google Shopping and Hotels – cannot be preferred over other vendors.

Now, this is a little too late to help the companies that Google already destroyed with their search monopoly (i.e. the shopping comparison engines that were destroyed by Google Shopping).

BUT it's not too late for OTAs and aggregators in the travel space.

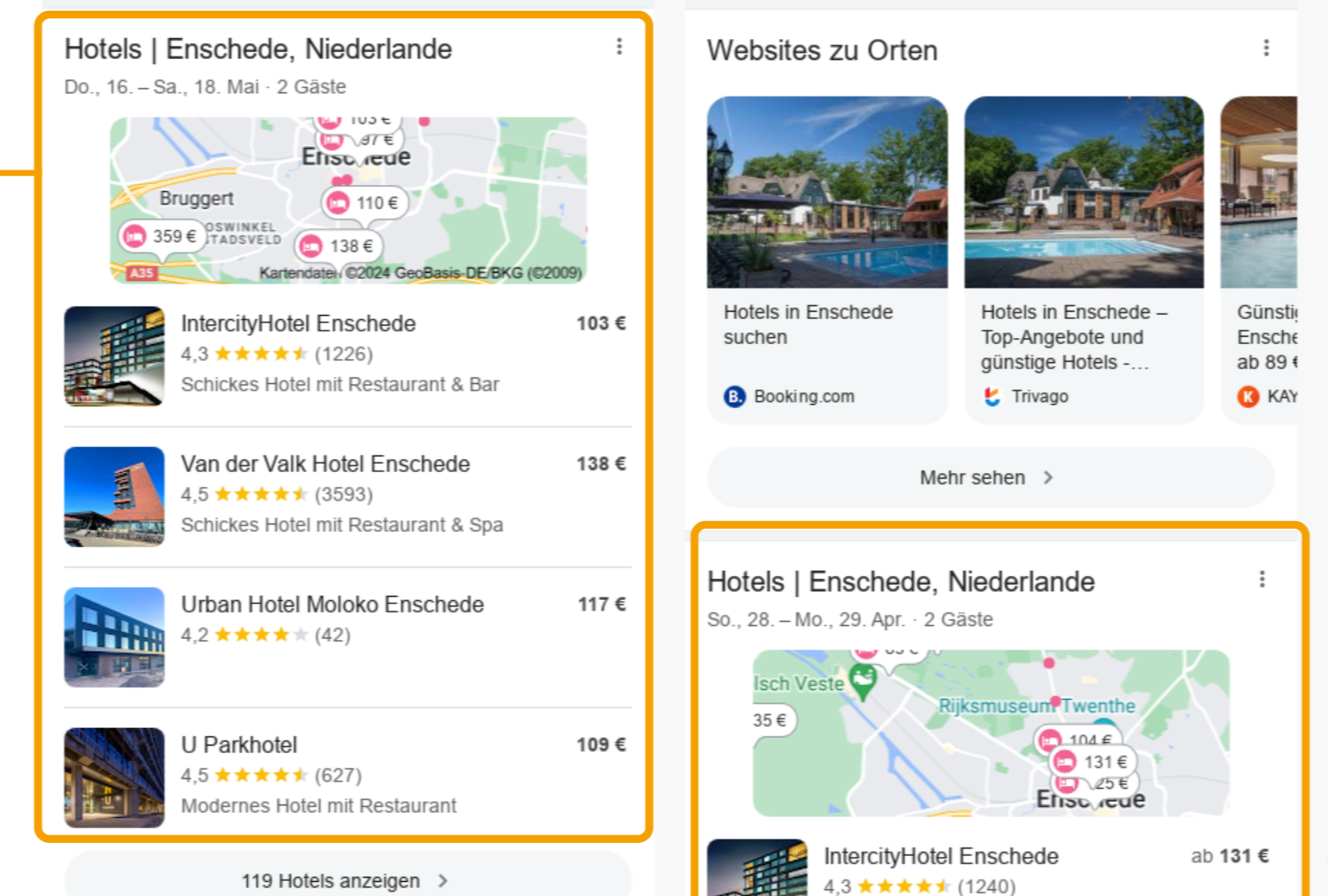

New “Comparison Sites” SERP Feature

To comply with the EU Digital Markets Act on Search, Google is adjusting European search results to give more prominence to “comparison sites.”

A blog published by Google on the subject of their DMA preparations states:

We will introduce dedicated units that include a group of links to comparison sites from across the web, and query shortcuts at the top of the search page to help people refine their search, including by focusing results just on comparison sites. For categories like hotels, we will also start testing a dedicated space for comparison sites and direct suppliers to show more detailed individual results including images, star ratings and more.

As a result of these changes, certain SERP features such as the Google Flights unit will be removed.

Google only started rolling the Comparison Sites search feature out in Germany, France, and some other countries in the beginning of March.

Changes to the Google Hotel Pack

The Google Hotel Pack provides extremely high visibility – around 95% of the time, it ranks in the Top 3 rank positions.

This enables hotels to leapfrog OTA’s in search visibility without competing with traditional web rankings. As a result, most travel and hotel sites likely track the bookings, clicks, and calls that come through this Google pack.

But this is now being outranked by the new Comparison Sites SERP feature. So where you would usually search for “hotel sur Paris” and see this hotel pack, you now get this big block that shows up at the top.

Every time a new SERP feature or result shows up above another, the clicks of the result that was demoted get cannibalized by between 5 to 10%.

But this is not just a standard web result. It's nearly 500 pixels tall which is about half the scroll deck of a standard page.

As a result, the impact is much bigger than what we typically anticipate for a normal SERP feature.

In addition to more generic terms like the one in the previous example, this feature also shows up and impacts brand searches.

Research Study: How Often the Comparison Site SERP Feature Occurs and Where

We set out to study what the actual impact might be. First, we wanted to understand how often the Comparison Site SERP feature occurs and where.

Distribution of Top 1 Rank Positions: March 1st 2024 vs April 26th 2024

Below is a picture of what was most commonly seen in the top one rank position on March 1st 2024 before Google began rolling out the new comparisons feature.

As previously mentioned, Google's hotel pack comprised over 95% of the top rankings, followed by about 2% for Google Maps, and a very small sliver left for sites like Booking.com, TripAdvisor, and others.

Now here's the picture on April 26, after the new comparison feature appeared to be fully rolled out in Germany.

Google's hotel pack has reduced from 95% to 70% of top positions, while the new comparison feature is nearly a quarter of those results.

So what's the net overall effect?

This side-by-side view helps us appreciate how much the landscape has changed for hotel results in the EU. But it's also interesting to note that in addition to Google's comparisons jumping so high, we still have a 2% occurrence of Google Maps and, in addition, a new knowledge panel.

So in sum, about 27% of the top-ranking positions are now not Google hotels. Of course, we can see that Google Hotels has certainly not gone away. What has changed is a little more subtle.

Google Hotels Top 1 Ranking Trend

From March 1 to just past mid-March, the presence of Google hotels remained pretty constant. Then around March 21 to 22nd, we saw this precipitous drop-off.

Overall, the presence of Google hotels in position one went from 146,000 of our 153,000 keyword set to around 108,000 at the end of our study period.

And here you can see that the new comparison feature replaced that nearly 40,000 keyword drop for Google hotels.

So overall, Google Hotels has a 26% decline in the top one rankings over this period.

But has it disappeared altogether out of a quarter of the keywords, or does it now appear elsewhere in the rankings?

Google Hotels Occurrence in Top 3 Rank Positions

When we look at the top three ranked positions, the hotel pack remains very stable with just a 3% decline. So it appears that Google Hotels gave up 26% of its top one rankings, but still stayed in the top three results in many cases.

And here's how that looks in the search results with March 1 on the left versus April 26 on the right.

The new hotel sites comparison feature has pushed the hotel pack feature down into second position, actually 380 pixels lower. That's the equivalent of the space taken by two regular search listings.

So essentially, the Google hotel listings have slipped down two positions because of the new SERP feature.

Occurrence of Hotel Pack and Comparison Sites

We broke down all the ways the new comparison feature shows up in the results and found that 46% of the over 150,000 keywords we looked at still show only the hotels pack as they did before the change.

A quarter of them now have the comparison feature at the top and then the hotel pack and another quarter are the reverse.

Surprisingly, almost half of the results in Germany still seem to not comply with the DMA requirements. This is probably why we have not seen the level of expected traffic loss as this came into action.

Impact on Traffic to Hotel Pack

OTA’s are expecting to see a bump up in traffic. This is because when the Hotel Pack originally came out, OTAs saw a decline in their traffic since hotels were able to leapfrog them in the results and show up in the top position through the Local Pack.

But now, OTAs can jump over the Hotel Pack and show up above hotels in the new carousel.

As such, Local Pack traffic for hotel chains will likely be impacted negatively.

Assuming a 26% decline in top one rankings for hotel packs, that should result in around a 50 to 66% drop in CTR. And given the search volume for those keywords, we would expect about an 18% estimated decline in traffic to hotels appearing in hotel packs.

So what impact does this have on the top organic results since they are also being pushed down by the new feature when it occurs?

Unfortunately, the impact remains unclear. That's because we don't know how much these sites might make up for lost traffic resulting from their top organic result being pushed down by being featured in the new comparisons carousel.

What Sites Are Seeing / Not Seeing an Impact

Many SEOs are confused as to why they’re not seeing the impact of the Comparison Sites SERP feature as significantly as they had expected, while others are noticing a huge impact on their site’s traffic.

Ultimately, the stronger your original visibility for web results and the stronger your presence is in the local pack, the larger the impact you're going to see.

If you start with a very high visibility, you'll see more than the 5 to 10% decrease in clicks that we normally expect. So it’s not unusual to expect somebody who's ranking in position one in local every single time to see a ~40% decline.

But if you're always in positions 2 and 3, the Hotel Pack has an intent that this new carousel does not meet.

For example, it’s not really useful for someone looking for a hotel specifically in Berlin.

The Hotel Pack allows you to see the map, see hotels, click through, and filter. That is still a better user experience in this case than clicking on one of the carousel results, going over to another site, and repeating all those steps.

So the impact of this carousel on your clicks will ultimately depend on your initial ranking and how much visibility you’re losing to this new SERP feature.

The Data: Who Is Winning Within the New Comparison Feature?

So who's dominating in the comparisons feature?

In Germany, by far, Booking.com shows up most often — over 40% of the time — dominating the first and most visible position in the carousel.

(Source: seoClarity Research Grid data-set April 2024 - May 2024)

And sure enough, on May 13 the European authorities declared that Booking.com was also a gatekeeper. We don't know how Google decides what gets into the comparison feature and how those are ranked. But given that booking.com was already ranking very well organically before this, we can surmise that standard search optimization practices can help.

Not surprisingly, the EU Commission still isn't satisfied with Google's level of compliance and further investigation is in progress which means we might expect more changes in the future.

Assessing Available SERP Space Above the Fold for Web Results

The gray portion of the bars here represents the level of non-opportunity for someone to rank in the first fold of results with their organic web listing. In other words, it's the percent of results where space is being taken up by Google features, so it's not possible to get your organic listing to number one.

(Source: seoClarity Research Grid data-set April 2024 - May 2024)

Notice how large that has grown since the introduction of the comparison feature.

The dark blue portion at the bottom, which represents the instances where an organic web result is actually in the top fold, has dropped to a sliver.

As we've seen, Google's first attempt at minimal compliance with the mandate in the EU DMA to stop favoring its own services and travel-related searches was to create a new SERP feature that only shows up about half the time.

Obviously, there will be a reaction from the EU that Google will have to respond to, making it likely we'll see more changes down the road.

For now, it's actually more difficult than before for hotels and OTAs to get their organic web listings ranked in the top three in EU results, which might be offset to some degree if they rank in the new comparisons feature.

Rest assured, seoClarity will monitor the situation as it develops and will update you on any change in the potential impact we see.

Research Methodology:

We grounded our study in our proprietary Research Grid, which tracks over 500 million total search queries in over 90 countries, making it the largest travel keyword data set available.

We mined our data from March 1, just before the new Google feature started massively rolling out in Europe, until April 26, when we were sure it was completely rolled out. This gave us a good before and after for the new Google feature which hasn't changed significantly since then.

We used Germany as our focus, as the data for the top five EU countries are nearly identical. This gave us 156,000 hotel-related keywords to look at. All the comparisons are based on mobile data as that's where most travel traffic comes from.

How to Prepare for the SERP Changes

The new structured data carousels that Google recently introduced can help you win additional visibility for the position you're in.

These are new rich results that people can scroll horizontally to see more entities from a given site (also known as a host carousel).

Each tile in the carousel may have information from your site about the price, rating, and images for entities (hotels) on the page.

Our free plugin, Schema Builder, can help you easily generate the schema for this which you can then implement through Google Tag Manager or you deploy through ClarityAutomate. No dev resources needed!

How to Measure the Impact of the Comparison Sites SERP Feature

So now that we understand the impact, how can you actually measure what's going on?

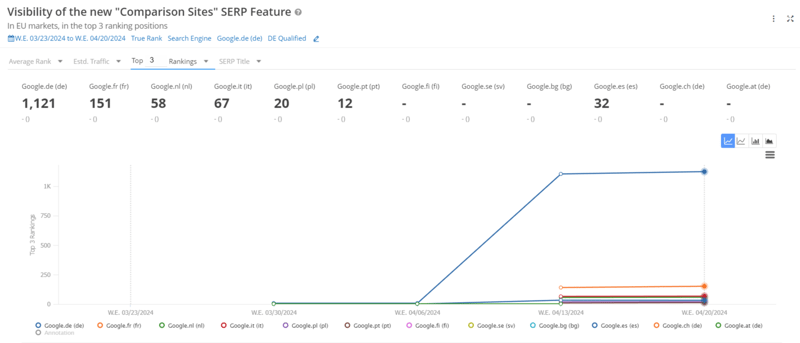

Back in March, we introduced the ability to track this particular SERP feature uniquely in seoClarity, which we labeled the “Comparison Site SERP Feature.”

This allows you to see the prevalence of the Comparison Sites SERP feature for all your tracked keywords across different countries.

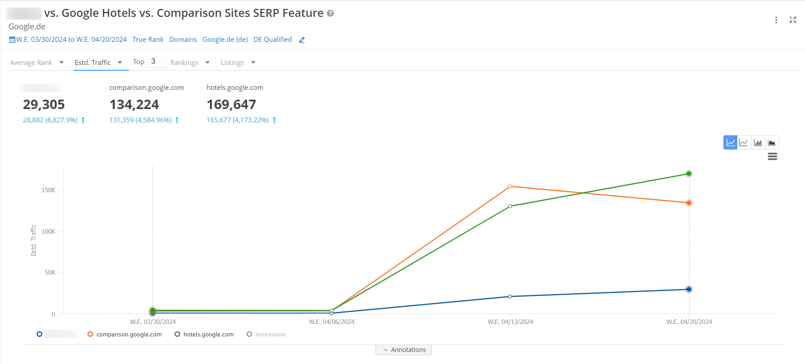

You can also compare the organic presence of your site vs Google Hotels vs Comparison Sites.

Another option is to track rankings for your top keywords against Google's Comparison SERP feature and the original Hotels Pack.

.png?width=810&height=366&name=Screenshot%204-22-2024%20at%2010.08%20(1).png)

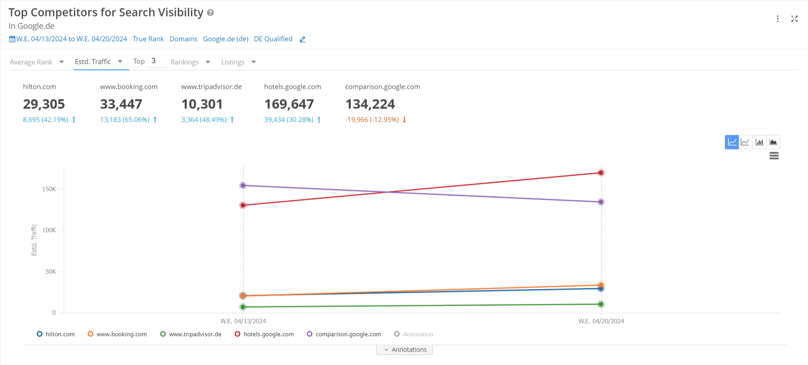

Plus, you can keep an eye on how your top competitors’ search visibility has been impacted by the new SERP feature.

The Google “Industry Domination” Playbook

We've discovered that Google has a very simple playbook that it follows when it comes to dominating industries.

This “industry domination” playbook includes the following steps:

- Identify high-volume terms: Google leverages its dominant position in search to determine what people search for in high volumes on a regular basis (i.e. the weather).

- Identify data sources: Instead of sending people away from their website for those high-volume terms, Google identifies data sources (via public sources, partnerships, acquisitions) which they then use to create a new “search” feature.

- Drive adoption of the new feature: Free inclusion in “beta” feature to reach a critical mass of data (i.e. when the hotel pack first came out, all hotels were invited to join in for free).

- Drive visibility: As a “SERP feature” initially. Dedicated property follows quickly.

- Cross Promote: Leverage strengths in other Google products like Maps and Gmail to drive deeper engagement.

- Monetize: Google monetizes by introducing Ads/Paid Placement within the property or as an alternative. Ultimately, Google runs on ads and that's the only way for them to make money.

Here’s a chronological list of the industries that have been impacted:

- Shopping Engines

- Public data Aggregators

- Weather

- Flight tracking

- Tools

- Calculators (Simple, Mortgage, Conversions)

- News Aggregators

- Sports Facts

- Sports Scores

- Online Travel Agencies

- Hotels

- Flights

- Online Directories

- Vacation Rentals

And continuing…

Conclusion

There is still a lot to learn about how the EU Digital Markets Act and Google’s response to it will impact search over time.

As such, monitoring these changes and their effects on your site’s traffic and search visibility is essential.

To learn more about how seoClarity can assist you in tracking these developments and optimizing your strategies, schedule a demo today!

<<Editor's Note: This piece was originally published in April 2024 and has since been updated.>>

Comments

Currently, there are no comments. Be the first to post one!